Depreciation formula example

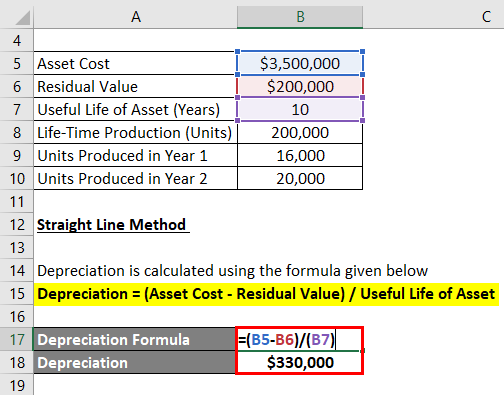

Depreciation is calculated using the formula given below. Well use an office copier as an example asset for calculating the straight-line.

Depreciation Formula Calculate Depreciation Expense

The extract of which can be seen in the below image from Audit Report of Reliance.

. Let us look at a detailed example when a company prepares its tax income 1 accounting for depreciation expense and 2 not taking depreciation expense. Depreciation tax shield Tax Rate x Depreciation Expense. Salvage is listed in cell C3 10000.

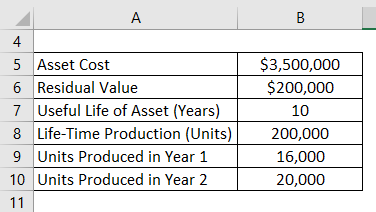

The difference using formula1 and formula 2 is because of some one-time expenses such as the acquisition of joint venture Joint Venture A joint venture is a commercial arrangement between two or more parties in which the parties pool their assets with the goal of performing a specific task and each party has joint ownership of the entity and is accountable for the costs. Next determine the explanatory or independent variable for the regression line that Xi denotes. Unit of production method if the machinery produces 16000 units in year 1 and 20000 units in year 2.

Mathematically it is represented as. Y a b X. For our example scenario well assume.

The double declining balance depreciation method is one of two common methods a business uses to account for the expense of a long-lived asset. Depreciation Formula Example 1. For example if straight line depreciation rate is 10 and the company uses a 200 of the straight line depreciation rate the accelerated depreciation rate to be used in declining balance method would be 20.

Let us calculate the accumulated depreciation on the balance sheet at the end of the financial year ended December 31 2018 based on the following information. An investment of 200000 is expected to generate the following cash inflows in six years. We need to compute the cumulative cash inflow and then apply the following formula.

100000 and the useful life of the machinery are 10 years and the residual value of the machinery is Rs. Depreciation is a non-cash expense and has therefore been ignored while calculating the payback period of the project. Double declining balance method.

Annual Depreciation expense 100000-20000 10 Rs. Modified Accelerated Cost Recovery System MACRS Method. Depreciation is estimated at 20 per year on the book value.

The cost is listed in cell C2 50000. To illustrate an example. Lets break down how you can calculate straight-line depreciation step-by-step.

Purchase or acquisition price of the asset - estimated salvage value of asset useful life of asset straight-line depreciation As you can see this formula is fairly simple to perform and offers a straightforward estimate as to the depreciation value of an asset. For example the annual depreciation on an equipment with a useful life of 20 years a salvage value of 2000 and a cost of 100000 is 4900 100000-200020. The Regression Line Formula can be calculated by using the following steps.

Double Declining Balance Depreciation Method. On 1 January 2016 XYZ Limited purchased a truck for 75000. Accumulated depreciation formula after 3 rd year Acc depreciation at the start of year 3 Depreciation during year 3 40000 20000 60000 Example 2.

Example Suppose a manufacturing company purchases machinery for Rs. You are free to use this image on your website templates. Straight Line Depreciation Formula.

The straight line depreciation formula for an asset is as follows. Cost of asset. Vehicles help in transportation of goods and people packaging machines in industrial setups perform the function of packaging of final.

We also provide a Statistics calculator with a downloadable excel template. These ratios indicate the companys cash level liquidity position and the capacity to meet its short-term liabilities. The most common is called the double-declining balance which is an accelerated depreciation model.

And life for this formula is the life in periods of time and is listed in cell C4 in years 5. We take an example of Reliance Industries Ltd. Here we discuss how to calculate the Statistics along with practical examples.

The calculation of depreciation under this method will be clear from the following example. The formula for calculating straight-line depreciation is as follows. Reliance uses the Straight Line Method of charging Depreciation for its certain assets from Refining Segment and Petrochemical Segment and SEZ Unit Developer.

Regression Line Formula Y a b X. 8000 as the depreciation expense every year over the next ten years as shown in the. Firstly determine the dependent variable or the variable that is the subject of prediction.

If the salvage value is assumed to be zero then the depreciation expense each year will be higher and the tax benefits from depreciation will be fully maximized. Divide the sum of step 2 by the number arrived at in step 3 to get the annual depreciation amount. Company ABC bought machinery worth 1000000 which is a fixed asset for the business.

As mentioned above this means the depreciation deductions will be bigger at the beginning of the term and decrease over. Company A purchases a machine for 100000 with an estimated salvage value of 20000 and a useful life of 5 years. You may also look at the following articles to learn more Example of Arithmetic Mean Formula.

Depreciation for the company is calculated using the straight-line method which is 90000 per year for the. The formula for Ratio Analysis can be calculated by using the following steps. The depreciation formula is Depreciation Expense Remaining Life Sum-of-Years Digits X Cost Salvage Value Different Aspects of Straight Line Method of Depreciation.

Annual Depreciation Purchase Price of Asset Salvage Value Useful Life. Calculating Depreciation Under Reducing Balance Method. The formula to calculate depreciation with the SYD method is as follows.

It is denoted by Y i. Current Ratio Current Assets Current Liabilities. You can use a basic straight-line depreciation formula to calculate this too.

Or Y 514 040 X. This method is used by income tax authorities for granting depreciation allowance to assesses. Accumulated Depreciation Formula Example 1.

The formula for gross margin is very simple and can be derived by dividing the difference between the net sales and the cost of goods sold by the net sales which is then expressed in terms of percentage by multiplying with 100. Depreciation rate is the percentage decline in the assets value. Gross Cost as on January 1 2018.

The formula for Gross Margin Formula. Double-Declining Method Depreciation Double-Declining Depreciation Formula To implement the double-declining depreciation formula for an Asset you need to know the assets purchase price and its useful life. Calculation of Mode.

First Divide 100 by the number of years in the assets useful life this is your straight-line depreciation rate. Lets create the formula for straight-line depreciation in cell C8 do this on the first tab in the Excel workbook if you are following along. We need to define the cost salvage and life arguments for the SLN function.

The formula of some of the major liquidity ratios are. Formula for the Calculation of Depreciation Rate. How to Calculate the Median.

Calculate the trucks depreciation for 2016 2017 and 2018. This is a guide to the Statistics Formula. Suppose the cost of asset is 1000 and rate of depreciation 10 pa.

It represents the depreciation expense evenly over the estimated full life of a fixed asset. Thus the company can take Rs. Salvage Value Example Calculation.

A few different methods can be used to calculate appliance depreciation in rental properties. It has a useful life of 10 years and a salvage value of 100000 at the end of its useful life. Depreciation Tax Shield Formula.

The depreciation rate that is determined under such an approach is known as declining balance rate or accelerated depreciation rate. Straight Line Depreciation Formula Example 2.

How To Use The Excel Sln Function Exceljet

Depreciation Formula Examples With Excel Template

Depreciation Rate Formula Examples How To Calculate

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Examples With Excel Template

Straight Line Depreciation Schedule Calculator Double Entry Bookkeeping

Depreciation Calculation

Depreciation Formula Examples With Excel Template

Straight Line Depreciation Formula And Calculation Excel Template

Depreciation Of Fixed Assets Double Entry Bookkeeping

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Examples With Excel Template

Depreciation Formula Examples With Excel Template

An Excel Approach To Calculate Depreciation Fm

Annual Depreciation Of A New Car Find The Future Value Youtube

How To Use The Excel Syd Function Exceljet

5 2 Ex 1 Financial Maths Depreciation Youtube